Beneficiaries’ Comprehensive Guide on BISP Digital Accounts and Withdrawal Fees 2026

By the end of 2025, the Benazir Income Support Programme (BISP) has successfully transformed its payment system into a fully digital model. According to the latest update issued in January 2026, all eligible women enrolled in BISP now have active digital bank accounts in their own names.

This major reform aims to eliminate the long-standing problems associated with campsites and middlemen while improving transparency, security, and convenience for millions of beneficiaries across Pakistan. However, along with these improvements, some new withdrawal fees and verification rules have been introduced. Understanding these changes is essential so that beneficiaries can withdraw their payments confidently and safely.

Also read more: BISP Finger Verification at NADRA 2026

Quick Overview: BISP Digital Accounts & Fees 2026

Under the new system, BISP payments are deposited directly into a Social Protection Bank Account. These accounts are managed through partner banks, ensuring that funds reach beneficiaries without unnecessary deductions or delays.

Key highlights include:

-

Quarterly payment: Rs. 13,500 (standard payments)

-

Partner banks: HBL, Bank Alfalah, Bank of Punjab, and Mobilink Microfinance Bank

-

ATM withdrawal fee: Rs. 100 to Rs. 200 (depending on the bank and ATM used)

-

SMS alerts: Completely free

-

Account balance limit: No limit — funds remain safe until withdrawn

-

Verification: Biometric verification, ATM PIN, and OTP (where applicable)

What Are BISP Digital Bank Accounts?

Previously, BISP payments were distributed through designated agents and temporary campsites. Women often had to stand in long queues and travel far from their homes, and unfortunately, many agents deducted illegal amounts ranging from Rs. 500 to Rs. 1,000 from each payment.

To address these issues, the government introduced personal digital bank accounts for every eligible woman in collaboration with national and microfinance banks.

Now, instead of funds going through agents, the money is transferred directly into a bank account registered in the beneficiary’s name. This allows women to:

-

Withdraw cash from ATMs

-

Visit bank branches for assistance

-

Keep their money safe in the account for future use

This shift has significantly reduced exploitation, delays, and unauthorised deductions.

The Reality Behind the Rs. 100–200 Withdrawal Fee

Many beneficiaries are concerned about the withdrawal charges being applied when they take money from ATMs. It is important to understand that these charges are bank-imposed fees, not deductions by BISP.

Why Is This Fee Charged?

-

Inter-Bank ATM Charges

If a beneficiary withdraws money from an ATM that does not belong to her account’s partner bank, a standard inter-bank fee applies. This fee usually ranges between Rs. 100 and Rs. 200, following national and international banking rules. -

Account Maintenance and Security Costs

Digital accounts require system maintenance, cybersecurity protection, and transaction processing. Banks charge a small fee per transaction to cover these operational expenses. -

Comparison with the Old System

Under the old campsite model, illegal deductions were far higher and completely unrecorded. Compared to that, a documented and legal bank fee of Rs. 100–200 is significantly lower and transparent.

It is important to note that no extra fee is charged by BISP itself. The amount is deducted automatically by the bank and appears in transaction records.

January 2026: New Verification Policy Explained

Starting from January 2026, BISP has strengthened its security framework by introducing Two-Factor Authentication (2FA) for withdrawals.

Earlier, biometric verification alone was sufficient. However, to prevent fraud and unauthorised withdrawals, additional safeguards have now been implemented.

| Topic | Short Details |

|---|---|

| Payment Amount | Rs. 13,500 (quarterly) |

| Account Type | Personal Digital Bank Account |

| Partner Banks | HBL, Bank Alfalah, BOP, Mobilink |

| Withdrawal Fee | Rs. 100–200 (bank charge, not BISP) |

| SMS Alerts | Free (only from 8171) |

| Balance Limit | No limit, money stays safe |

| Verification | Biometric + ATM PIN / OTP |

| Fraud Helpline | 0800-26477 |

New Verification Requirements:

-

ATM PIN Code: Beneficiaries must enter their secret PIN at the ATM.

-

OTP (One-Time Password): In certain cases, an OTP is sent to the registered mobile number to complete the transaction.

This system ensures that only the rightful account holder can access the funds, even if the ATM card or CNIC information is misused.

How to Withdraw BISP Payment: Step-by-Step Guide

Beneficiaries can follow these simple steps to withdraw their Rs. 13,500 payment safely:

-

Visit the nearest ATM of a partner bank (recommended to reduce fees).

-

Insert your BISP ATM card or select the biometric withdrawal option.

-

Enter your 13-digit CNIC number when prompted.

-

Put your thumb on the biometric scanner to confirm.

-

Enter your ATM PIN if required.

-

Select or enter the withdrawal amount.

-

The ATM will dispense cash after successful verification.

(Remember: Rs. 100–200 may be deducted as a bank fee.)

If the transaction fails, the deducted amount is usually reversed automatically within a short period.

Also read more: Funds to Reach Banks on January 6, 2026

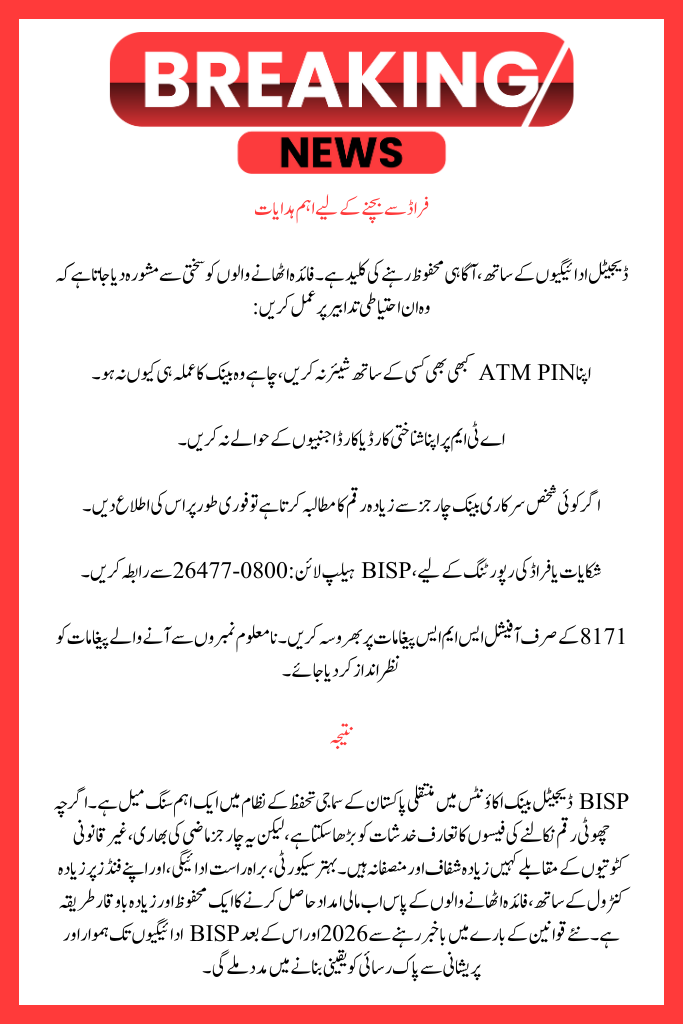

Important Guidelines to Avoid Fraud

With digital payments, awareness is key to staying safe. Beneficiaries are strongly advised to follow these precautions:

-

Never share your ATM PIN with anyone, even if they claim to be bank staff.

-

Do not hand over your CNIC or card to strangers at ATMs.

-

If any person demands money beyond official bank charges, immediately report it.

-

For complaints or fraud reporting, contact the BISP Helpline: 0800-26477.

-

Trust only official SMS messages from 8171. Messages from unknown numbers should be ignored.

Conclusion

The transition to BISP digital bank accounts marks a major milestone in Pakistan’s social protection system. While the introduction of small withdrawal fees may raise concerns, these charges are far more transparent and fair compared to the heavy, illegal deductions of the past. With improved security, direct payments, and greater control over their funds, beneficiaries now have a safer and more dignified way to receive financial support. Staying informed about the new rules will help ensure smooth and trouble-free access to BISP payments in 2026 and beyond.

FAQs

1. Do recipients have to pay a withdrawal charge to BISP?

No, there are no withdrawal fees imposed by BISP. Banks typically impose a deduction of between Rs. 100 and Rs. 200, particularly when using ATMs that are not part of the partner bank network.

2. If I don’t take my BISP money out right away, will it stay in the digital account?

Yes, you can keep your BISP payment securely in your online bank account for as long as you’d like. The funds won’t run out if you wait to withdraw them, and there isn’t a balance cap.

3. How should I respond if someone requests additional funds in order to release my BISP payment?

You shouldn’t give somebody more money. Report such occurrences right away to the BISP helpline at 0800-26477, and only believe official communications from 8171.